How much will my flood insurance cost?

The cost of your flood insurance will depend upon your properties location and a number of other factors such as:

- Flood risk (e.g., your flood zone);

- The type of coverage being purchased (e.g. building and contents coverage);

- The deductible and amount of building and contents coverage;

- The location of your structure;

- The design and age of your structure;

- The location of your structure’s contents (e.g. Are your utilities elevated?).

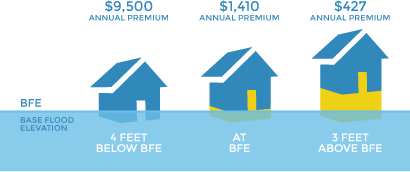

These factors will impact the cost of your flood insurance premiums. For example, if you are located in an A Zone, which is a high-risk flood zone, and your first flood is located below the Base Flood Elevation (BFE), your premiums would be higher than your neighbor's who is located in the same zone but has a first floor elevated above the BFE.

No matter the cost of your flood insurance premiums, the potential financial devestation that may result from a flood while not being covered is hardly worth the risk. It is important that all property owners understand their exposure to flood risk and the potential losses that may result.

No matter the cost of your flood insurance premiums, the potential financial devestation that may result from a flood while not being covered is hardly worth the risk. It is important that all property owners understand their exposure to flood risk and the potential losses that may result.

* Please note that the image above is for illustrative purposes only and may not represents premium rates in Cranford.

Source: Center for NYC Neighborhoods graphic based on rates from FEMA

For more information, please contact your flood insurance provider or reach out to the Township's Office of Planning & Zoning. Please understand that the Township cannot provide cost estimates or review your policy.

Updated April 8, 2020